The food and beverage industry has undergone its fair share of change over the past few years. Demand underwent a dramatic shift in favor of retail over foodservice during the COVID-19 pandemic, with meal kits and home delivery skyrocketing in popularity. Today, the global economy is in a state of flux, and companies are learning to adapt and operate under a new paradigm.

Meanwhile, technology continues to advance and become more central for both how consumers live their lives as well as the ways that companies overcome challenges and innovate. While there remains much uncertainty, it’s also an exciting time as there are opportunities for growth across all food and beverage sectors — but it will take a keen understanding of the various factors at play to attain success.

As we near the end of 2022, many of the lessons learned and habits formed will continue to shape the food and beverage industry in the coming year. Here are the top three food and beverage industry trends to look out for in 2023. Xtalks spoke with two experts to hear their insights, expectations and predictions for next year.

1. The Next Generation of Plant-Based

Previous years saw unprecedented growth for the plant-based food and beverage industry. 2021 sales reached $7 billion, which represented a 27 percent increase from 2019. Moreover, plant-based foods grew almost 2.5 times faster than total food sales from 2018 to 2020, according to the Good Food Institute.

However, plant-based alternatives didn’t have the breakthrough year that many experts predicted. This could partially be due to the recovery of the traditional meat industry, the crowded nature of the plant-based alternatives space or the lack of differentiation among the most prevalent brands, like Beyond Meat and Impossible Foods.

So, what does 2023 have in store for plant-based foods? Bradley Saxe, President of Mainline Foods — a contract food manufacturer that produces both US Food and Drug Administration (FDA) and US Department of Agriculture (USDA) foodservice and retail food products — says he doesn’t see it being widely adopted in its current form.

“It’s a tough product because if you’re a vegetarian, most likely you don’t want to eat meat. So why would you go eat a fake burger?” Saxe says. “It’s not a cheaper alternative. And if it does become a cheaper alternative, I could see it definitely having a larger market share than it does today. But in its current form, it’s not. So, we’ll see what happens.”

However, Michael Sanguinetti, a personal and private chef as well as the business development and market specialist at INTUEAT — a luxury on-demand dining platform — says that we are entering the next generation of plant-based. This generation will focus more on chefs and food makers getting creative with vegetables and making them more of a star than just using meat substitutes.

However, Michael Sanguinetti, a personal and private chef as well as the business development and market specialist at INTUEAT — a luxury on-demand dining platform — says that we are entering the next generation of plant-based. This generation will focus more on chefs and food makers getting creative with vegetables and making them more of a star than just using meat substitutes.

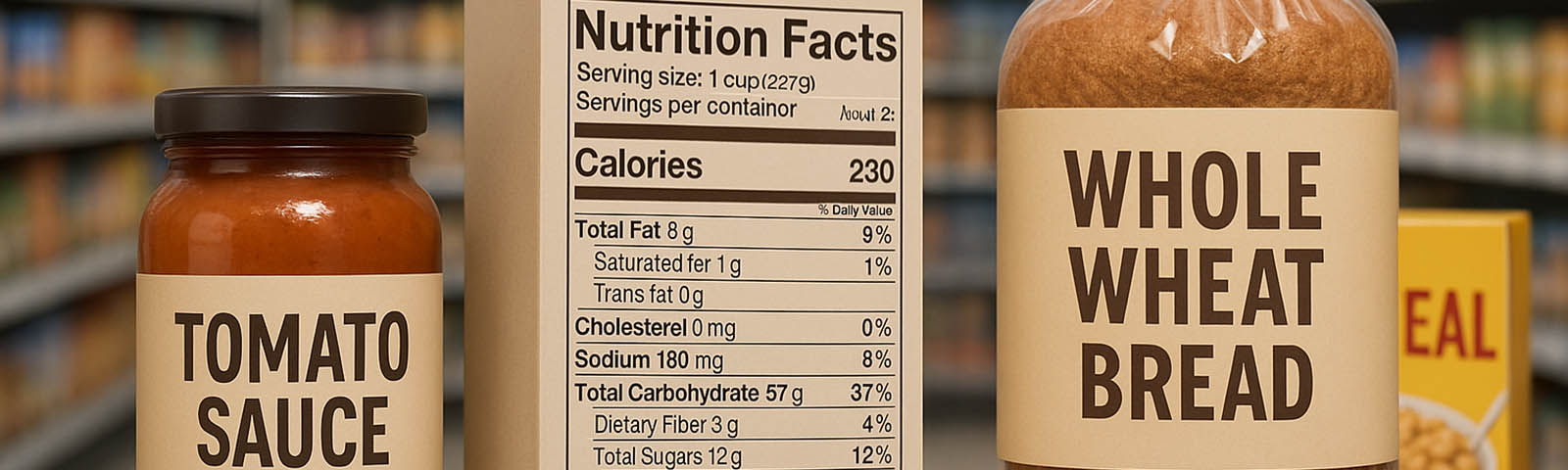

“Consumers are realizing that these meat substitutes have a lot more ingredients in them. They’re not simple. A lot of salt heavy stuff,” Sanguinetti says. “I think there was a stigma for a long time with plant-based. You could have a rib eye versus a carrot and everybody’s like, ‘Well, I’ll take the ribeye.’ Now, there’s no stigma. It’s just part of the menus that are being created.”

Tastewise — an artificial intelligence (AI)-powered food intelligence platform — pointed out in its 2023 trend report that while the plant-based category is often at the center of conversations about sustainability, people eat plant-based for personal health reasons 16 times more than for sustainability concerns. The report finds that plant-based diets are becoming more popular, with alternative dairy and meat showing higher interest when consumers talk about health.

So, if consumers are more interested in plant-based diets for personal health rather than sustainability concerns, what does a realistic sustainable food system look like?

2. A Realistic Sustainable Food System

In the last five to ten years, there has been a growing movement on the part of consumers to shop more sustainably when it comes to personal and planetary health. Since food production and subsequent waste account for a large percentage of greenhouse gas emissions, sustainability in the food industry is becoming more of a necessity rather than an option.

“We’ve seen a lot of consumer interest in some of our sustainability practices and we’ve become a little bit more transparent in what we actually do,” Saxe says regarding some sustainability practices at Mainline Foods. “Instead of just doing it, we’re showing it, we’re putting it on the packaging, we’re talking about it.

So, what does a realistic sustainable food system look like in practice? Saxe says it’s an ecosystem — it’s not just about buying recyclable cardboard or using fuel-efficient methods of transportation. Rather, it’s all the way from inception to end product. That often starts with sustainable farming, from cows to cod to corn and everything in between.

To Sanguinetti, less is more. “The more we practice sustainable farming and fishing, the more consumers can actually say, ‘This is a high quality product from start to finish.’ You can trust your farmer and your rancher and your fishmonger that they’re giving you the best product. Because if they didn’t, then you wouldn’t buy from them.”

To Sanguinetti, less is more. “The more we practice sustainable farming and fishing, the more consumers can actually say, ‘This is a high quality product from start to finish.’ You can trust your farmer and your rancher and your fishmonger that they’re giving you the best product. Because if they didn’t, then you wouldn’t buy from them.”

Saxe has seen this theory come to fruition in his company’s airline food and beverage business. “We’ve seen with our airline customers a big push on focusing on regional, locally grown items that still hit a price point because everyone’s price conscious. So, finding local farms that are raising in a sustainable way or raising in a system that’s sustainable is key.”

When it comes to the foodservice industry, Sanguinetti believes 2023 will be the year of smaller menus. As a lingering result of the COVID-19 pandemic, the logistical complexities and cost to have extensive menus is not as realistic as it was pre-pandemic.

“I think in the next five years we’ll see all restaurants disclose which farm their food comes from and even which person picked it out of the ground,” Sanguinetti says. “I think it’s going to become a trend where even fast foods are going to be like, ‘This is where we get our lettuce from.’ It’s going to be a good thing.”

In 2023, both Saxe and Sanguinetti expect to see a change in demand for brands and products that are produced in sustainable ways or that significantly reduce their carbon footprints. One way companies can do this is by upcycling excess food to minimize waste. Saxe says Mainline has already designed a system in which its excess bagels get sliced, baked and turned into chips. By cutting down on food waste, companies can also ensure they are not wasting energy, resources or money.

3. Social Media and Tech Savviness

With more food and beverage content available online than ever before, the landscape of marketing in the era of social media is changing. For the last decade, food and beverage companies could use social media platforms without spending an exorbitant amount of money on marketing. But Sanguinetti says that social media has become an advertising and information dump that consumers are being inundated with.

“I think marketing is trending away from social media where restaurants need to get more native and actually go back to, I wouldn’t say fully traditional, but something close to it,” Sanguinetti says. “So, I think there’s some more native stuff starting to be blended back in, especially with restaurants. It goes into the experiences too, where people are not just eating anymore, they really want to be part of something.”

The food industry is continuing to move away from traditional dining experiences in favor of more immersive and interactive experiences. This trend is being driven by several factors, including the increased popularity of video creation app TikTok, in which users share unique dining experiences with millions of viewers, as well as a desire to get out and see the world after a couple of years of lockdowns and restrictions.

While it is likely that food and beverage companies will continue to use a combination of traditional and social media marketing, Sanguinetti says that tech savviness will be crucial for chefs, companies, restaurants and the entirety of the food and beverage industry.

“I think we’re in a great transition in the food industry and tech, especially. If you don’t understand how tech, all tech, from robots to delivery services work, you’re at a disadvantage,” Sanguinetti says. “As a chef, if you don’t know these things or as a farmer or restaurateur, if you don’t really grasp how tech’s going to affect you in the future and you just let it continue, it’s just going to kind of run you over.”

“I think we’re in a great transition in the food industry and tech, especially. If you don’t understand how tech, all tech, from robots to delivery services work, you’re at a disadvantage,” Sanguinetti says. “As a chef, if you don’t know these things or as a farmer or restaurateur, if you don’t really grasp how tech’s going to affect you in the future and you just let it continue, it’s just going to kind of run you over.”

To which technology is Sanguinetti referring? Everything from advancements in agriculture technology (AgTech) with innovations like crop rotations to improve soil health and optimize nutrients to food traceability technology to improve safety and prevent foodborne illness outbreaks. In food packaging, Saxe says Mainline is working with a tech company that can transform its plastic purchasing to recyclable oven heat proof type of containers.

Other Food and Beverage Industry Trends for 2023

Saxe anticipates that consumers will be looking for more exotic flavors in 2023. His company has received positive feedback on pulling from different cuisines and different cultures and its R&D kitchen continues to find new innovative tastes and smells. Specifically, he predicts that new exotic fruits and vegetables will enter the market next year.

Sanguinetti expands upon that prediction by suggesting that Southeast Asian cuisines, including Vietnamese and Laotian, will continue to experience growth in the US next year. He also expects to see a push for craftspeople and trades in the food and beverage industry, including a resurgence of traditional butchers and bakers.

Lastly, both Saxe and Sanguinetti are hopeful that inflation rates will drop in 2023, especially after a year of astronomically high inflation rates.

Join or login to leave a comment

JOIN LOGIN