Millennials and Generation Z are becoming the exciting new target demographic for the food industry, and their food choices show striking differences from their predecessors. With a rising market of alternative protein and plant-based food items, this blog discusses changing shopping patterns and how meat retailers can re-design and market their products to gain younger customers while still maintaining their loyal clientelle.

The Food Marketing Institute (FMI) and the Foundation for Meat & Poultry Research, recently published the 14th edition of their Power of Meat 2019 study, providing insight for both meat distributors and food retailers.

The 2019 report surveyed US shoppers’ values, culture and claims, and found despite the rising popularity of faux-meats and plant-based food items, beef and poultry are still proving to be top sellers in the food industry and play a significant role in the financial success of supermarkets, raking in 67 billion dollars in annual sales.

While plant-based protein is proving to be a growing trend for North American consumers, and government publications such as the latest Canada Food Guide, omnivore eating preferences are still a dominating diet. According to the study, 86 percent of shoppers still consume meat, with only 5 percent of the population eating a purely vegetarian or vegan diet, a number that has remained relatively steady over the last 14 years.

These statistics are welcome news for those working in the meat industry, but that doesn’t mean there isn’t room for future concerns in emerging diet trends, ones that may leave the food industry fighting for their forkful of market share.

The latest challenge is posed by a unique diet known as flexitarian. Consumers who identify as “flex” are known as the ultimate “swing voter” in the world of food politics, they eat a mostly vegetarian diet, with occasional meat and poultry consumption. Younger people cite this diet choice for its supposed health benefits.

The research reveals that 13 percent of Generation Z consumers follow a flexitarian diet versus just 6 percent of Baby Boomers. Gender also plays a significant role, with females being 15 percent more likely to follow a flexitarian regime in comparison to their male counterparts at 6 percent.

If a flexitarian diet is known to be favored by younger generations for its nutritional value, the study suggests meat retailers should work more on advertising the importance of a balanced diet, as well as promoting health-based facts associated with animal protein, especially when alternative proteins are growing in popularity.

Marketing Health Benefits Through Labels

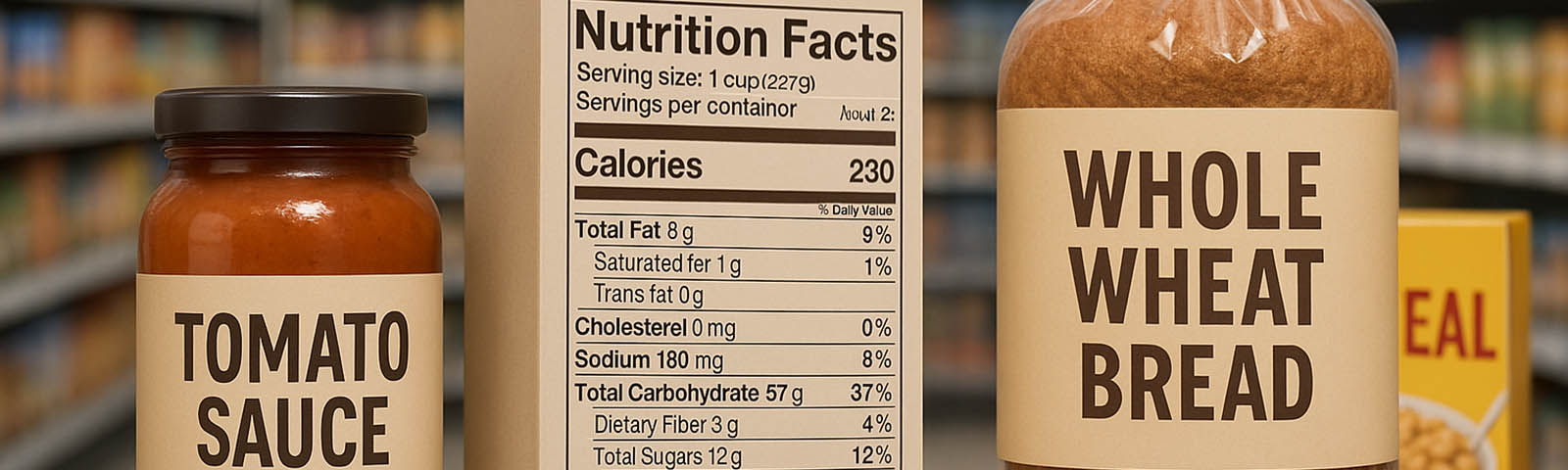

The study suggests one way to improve marketing is through more informative labeling. Consumers are starting to be more curious about animal welfare because as their own awareness of health and wellness grows, shoppers are drawing connections between production practices and their personal health.

According to the study, meat packaging can play a key role in marketing to this awareness. “Grass-fed”, “Natural”, and “Free-from”, are keywords in leveraging profit, with 56 percent of younger millennials stating they are drawn to “Grass-fed” and “All natural” labels, and 58 percent of Baby Boomers favoring the label “Anti-biotic free”, and 63 percent want to know where the animal was raised.

Although specific health claims vary in importance amongst age groups, “Grass-fed” beef and lamb scored the most favorable choice across all age groups, rounding to a total of 54 percent.

The study also found that fresh meat labeled as grass-fed experienced above-average growth in sales by 12.6 percent, and organically labeled fresh meat increased in sales by 15.0 percent, proving that health claims can help pave the way to profit.

As wellness and nutrition become stronger preferences in the food industry, 66 percent of shoppers are looking for ways to purchase “better-for-me” food items. When it comes to labels, incorporating information about positive animal raising practices, environmentally friendly production, and ethical labor practices will have a promising impact on meat sales. However, this is notably favored by younger consumers with above-average incomes, as well as a crossover from shoppers who hold social and environmental welfare interest.

Modifying Meat Products and Terminology

Although labeling is important to shoppers, the study shows there are other creative ways for meat retailers to ring in profits with health-conscious consumers.

This is particularly important when marketing to younger generations whose purchasing patterns show an increase in alternative protein choices, while baby-boomers are still more likely to seek leaner cuts of meat when maintaining their diet.

According to a Neilson study, shoppers in general, have a lack of knowledge about how much protein animal meat contains, and younger consumers seem most likely to opt for alternative products labeled “high in protein.” The report found a surprising 45-65 percent of consumers do not identify beef, chicken, and pork as a protein-rich source. This points to a need for more education and outreach by the meat industry and for clearer protein information labels.

Meat and vegetable-mixed dishes are also predicted to be a promising trend in the industry. It’s not that popular amongst meat consumers yet, especially boomers, but that looks as though it could soon change. In fact, 63 percent of consumers overall are open to “maybe” or “definitely” purchasing plant-blended meats, such as mushroom-infused meat burgers.

Interestingly, there is almost an even divide between consumers who are comfortable with plant-based food items being labeled under meat terminology and those who think only animal protein should be labeled under these claims.

As for the future of the emerging market of lab-produced meat, consumers still need convincing. Currently over half of the consumer surveyed (55 percent), disapprove of cell-based meat, such as beef and poultry.

Making Meat Convenient

When it comes to younger generations convenience drives market growth in the food industry as busy schedules and “on-the-go” lifestyles steer consumers away from meal items that include labor and time prep. According to the report, assortments of convenience-based meats have increased by 5.1 percent with growth comprised almost equally between fully cooked food items and frozen food items.

Despite these statistics, fresh meat still dominates American meals with 68 percent of shoppers voting it an essential part of their dinner. But this may not be the trend in the future, as Generation Z and younger Millennials show they are 10 percent less likely to purchase fresh meats when compared to older shoppers. As the population grows older and gains more financial leverage in the market, fresh food items could decline over time.

The view was supported in a recent Xtalks interview with Alison Bodor, the CEO of the American Frozen Food Institute. She believes the younger generation’s tendency for convenient food items will likely drive growth in the future as their lives become busy as adults. “Millennials are just at the early stage of their life-exploring having fun with frozen. As they have children, they are going to be leading very busy lives. They love this category so they’ve got many years ahead of them.”

Finally, the old days of checking a flyer or circular for sales before going to the grocery store are fading fast. The impact of in-store marketing and digital advertisement are creating new opportunities for retailers and suppliers to engage with meat shoppers. Taking the lead now is in-store signage, with 52 percent of shoppers making their purchases on the spot. However, digital versions of circular advertisement have increased by 38 percent, followed by grocery store-apps increasing at 24 percent and social media deals by 12 percent. This implies that the younger generation could be impacted more through digital platforms for food deals as opposed to in-store signage in the future.

A massive generational shift is taking place in the food industry, as indicated by changing dietary and product preferences. With that comes new challenges and new opportunity, and businesses who evolve with these changes will be the ones that see the greatest rewards.

Join or login to leave a comment

JOIN LOGIN